The Habitat Affordability Model

Don’t let the sale price fool you. While the recorded price of a Habitat home is based on its appraised value, families pay much less. Habitat homebuyers’ mortgage amounts are set so that families never pay more than 30% of their income on their total monthly housing expenses. Additionally, Habitat provides a zero interest (or zero interest equivalent) mortgage, saving families hundreds of thousands of dollars over the lifetime of their loan. To make this model sustainable, Habitat supplements the amount families can afford to pay with private and public fundraising to achieve the cost of building the homes. Selling the homes at fair market value maintains neighborhood property values and bolsters the partner families’ investment allowing them to build wealth to pass along to future generations.

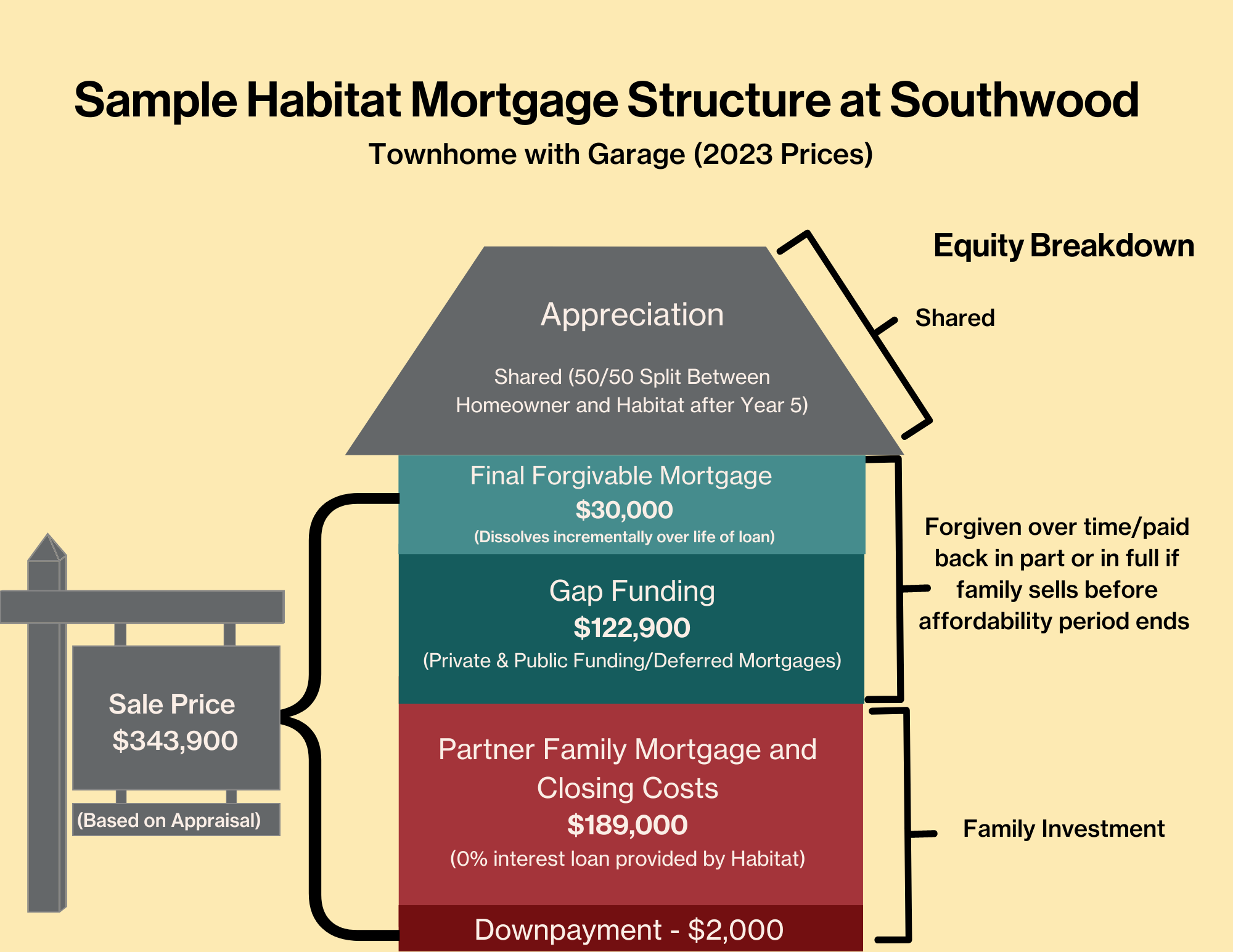

An example of this type of mortgage structure for a home sold at Southwood is below, followed by a sample Habitat home sale payment breakdown:

The below example features a payment structure for a Habitat townhome with garage, based on 2023 pricing. You can compare the estimated monthly cost of $1,050 to Fair Market Rent for the Charlottesville, VA HUD Metro FMR Area, which cites $1,063 for a 1-bedroom.

Frequently Asked Questions

Can everyone at Southwood afford to stay?

Yes. We promised non-displacement to everyone who was living in the park when physical redevelopment began in 2019. Hundreds of affordable homeownership and rental homes are available at all price points, with no one paying more than 30% of their income on housing expenses. To fit their individual family’s needs, Southwood residents choose from a variety of options, from condos to townhouses to single family detached homes inclusive of accessory dwelling units. In many cases, Southwood families will pay less in housing expenses to live in brand new homes than they currently pay to live in aging trailers. While there are currently 317 mobile homes on site, the new Southwood will feature upwards of 500 affordable units.

How do I qualify for purchasing or renting a Habitat home?

Anyone living in Southwood when General Information Notices were issued in 2019 is automatically qualified to purchase or rent in the new Southwood, regardless of income.

Habitat homebuyers:

- Must be willing to partner with Habitat by providing “sweat equity” on both home construction and other forms of volunteerism and class participation;

- Will take on an affordable mortgage.

Renters:

- Will pay fixed, below market rate rents for their homes, or, if they have an even greater financial hardship…

- Will participate in a financial certification process to ensure that they pay no more than 30% of their income on rent.

All Southwood families who would like to purchase or rent in the new Southwood should make an appointment to meet with Habitat's Southwood Rehousing Manager Claudia Thomas. Claudia can be reached at: cthomas@cvillehabitat.org

What exactly is a “mixed-income” community? Why is Habitat pursuing this model of development?

Since 2004 Habitat has been a national pioneer in creating new mixed-income communities and infusing existing neighborhoods with affordable housing. We believe in diverse, inclusive, and vibrant communities of neighbors that transcend socioeconomic and cultural divides. Additionally, as the developer of Southwood, Habitat is able to cross subsidize its affordable housing by selling market rate lots to private builders.

Don't Habitat homes bring down the property value of the other market rate homes surrounding them?

No! The sales price of Habitat homes are based on market rate appraisals at the time of sale. However, partner families only pay a mortgage amount that is affordable to them, well below the appraised value of the home. Habitat makes up the difference between what a family can afford and the sale price through private and public fundraising as well as by “cross subsidies” earned through market rate lot sales.

What if a buyer tries to flip a Habitat home for profit?

As a standard part of our contractual arrangements and the zero-interest mortgages we provide, Habitat includes numerous deed restrictions to help homes remain affordable long term. Habitat retains a 40-year “right of first refusal” to repurchase any home sold and incentivizes long term ownership by the original owner via forgivable mortgages that dissolve over time, ensuring that families who remain in their homes will benefit from increased equity. Because families helped build their own homes and communities and because Habitat’s subsidized mortgage program allows monthly housing expenses to be well below anything offered in the market, families tend to stay in their homes for generations while maintaining the freedom and financial empowerment enabled by homeownership.

Can low income families from outside of Southwood purchase homes in the community?

At this time, Habitat homeownership at Southwood is only available for families who have lived there since at least 2019. Our first promise to the community was that we would make sure everyone could be rehoused prior to opening spots for families outside of the community. However, through a partnership with the Piedmont Housing Alliance, 121 affordable rentals will be available at Southwood to the general community in the Hickory Hope Apartments beginning in roughly 2025. In later years, once everyone at Southwood who wishes to stay has been rehoused on site, we hope to open up Habitat homeownership at Southwood to families from around the region.